Five people from one of the largest Hong Kong real estate agency, Premier Capital were arrested after at least 28 Hongkongers accused the company of misleading them into buying derelict houses at inflated prices in the US.

Hong Kong police have arrested five people from one of the largest Hong Kong real estate agency specialised in overseas properties, including its managing director, after at least 28 Hongkongers accused the company of misleading them into buying derelict houses at inflated prices in the US.

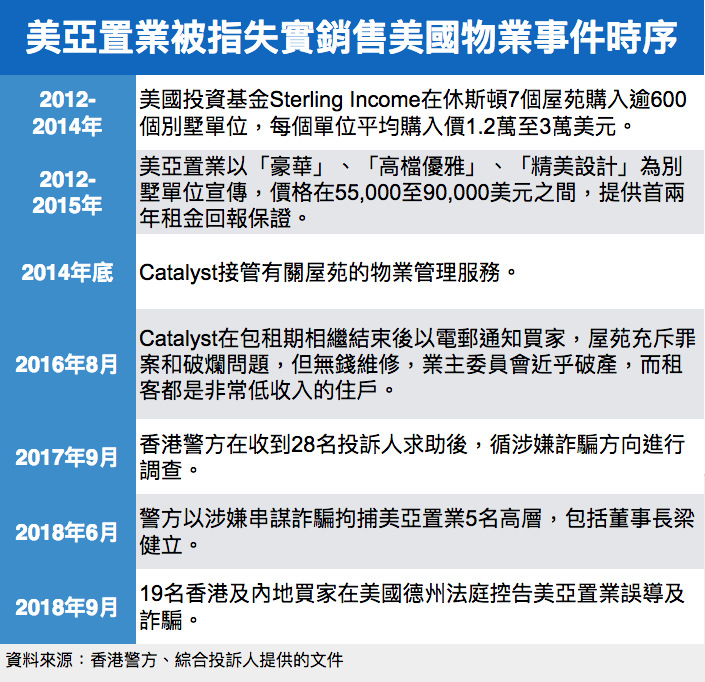

The alleged property scam centres on real estate agency Premier Capital, which between 2012 and 2015 sold nearly 600 homes at seven residential developments across Houston, Texas to investors in Hong Kong and mainland China, who paid around $340m in total.

The investors were offered to buy foreclosed luxury houses at prices ‘lower than construction costs’, with the promise of guaranteed 16 per cent rental return for the first two years.

In return, they had to sign a two-year contract to lease back the properties to the seller, investment company Sterling Income, who would handle the lettings and management and bear any maintenance costs.

However, as the guaranteed period expired and the rent stopped coming, many of them realised their properties were in conditions that their property manager described as ‘deplorable’, and had to fork out thousands of dollars on renovation and maintenance.

The investors also claimed that the properties were advertised as to mislead them to buy at prices at least three times their actual market value.

A group of 19 Hong Kong and mainland investors are now suing Premier Capital at a court in Texas for damages up to US$2m ($15.6m) over alleged fraud and misrepresentation.

They also accuse the seller of neglecting the repair and maintenance of their houses during the leaseback period.

In response to queries from FactWire, Hong Kong police said they had arrested three men and two women, aged from 41 to 60, on suspicion of conspiracy to defraud in June. In a statement, the spokesperson said the investigation was still under way and therefore could not rule out further arrests.

The Commercial Crime Bureau began investigation in September 2017 after receiving complaints from 28 victims, who lost a total of $18.4m after buying the problematic properties at investment seminars held by Premier Capital between 2012 and 2015.

A police source said Philip Leung Kin-lap, managing director of Premier Capital, was among those arrested when officers raided the company’s office in Sheung Wan. The 60-year-old businessman has frequently featured in newspapers and on TV commenting on overseas property markets.

The source added that the total number of victims was thought to be close to 100 – although based on the owners’ names on official property records seen by FactWire, the problematic properties are believed to have been sold to more than 400 Hong Kong people.

Premier Capital has continued to host property seminars every week after the police arrest in June. Its sales director, who was directly involved in selling the problematic properties and later admitted to FactWire to being one of the arrested company staff, was seen speaking at an event held at a five-star hotel in early November promoting luxury apartments in the UK.

The police did not explain why the arrest was not made public, only saying they ‘respect the public’s right to know’ and would ‘provide timely information to the media and the public depending on the nature of the case’.

The Houston properties were heavily advertised in newspapers by Premier Capital from the onset. One advertisement, which appeared from July 2013, promised buyers of ‘double-storey villas’ at Las Palmas condominium a ‘16 per cent net guaranteed return’ for the first 24 months on their investment in a US city with ‘the highest rental yields in 2012’.

Its sales brochure also stated that each unit came complete with furniture and appliance including refrigerator and dishwasher, and was situated in a ‘decent and safe’ neighbourhood.

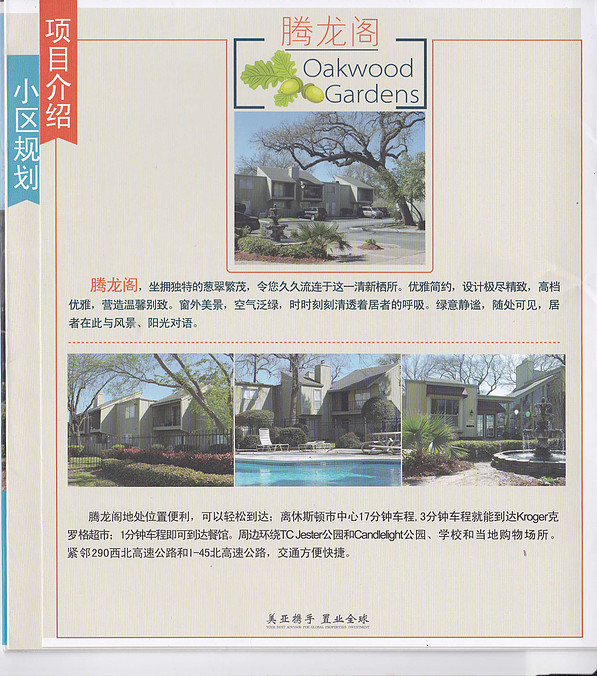

An advertorial in a major newspaper in June 2013 guaranteed the same return on ‘terraced villas with pool or garden view’ at another development called Oakwood Gardens.

One of the alleged victims Ms Hung bought a ‘newly-renovated’ three-bedroom house at Las Palmas for US$69,400 in 2014 after seeing the advert. ‘The salesperson told me that the properties were initially acquired by an investment fund at foreclosure sale and were typically rented to middle-class office workers,’ she said.

Hung, who flew to Houston to view the houses with some other owners after being hit with a huge maintenance bill once the guaranteed period ended in 2016, said the actual condition was a far cry from what was advertised.

‘The whole place is very unsafe, and some vacant houses were occupied by squatters,’ she said, adding that her property was under renovation at the time, but some neighbouring units were dilapidated, with windows boarded up and rubbish piling up outside.

She is now in the process of selling the house for US$54,000, after having spent more than US$17,000 on repair and refurbishment, resulting in a net loss of about US$27,000.

For another buyer Ms Kwok, who purchased a unit at the same condominium for US$72,000 in September 2013, her house turned out to have been occupied as a maintenance workshop since 2010 – well before Premier Capital marketed it as ‘fully-furnished’ home.

She eventually sold the house for just US$27,000 in 2017 after the seller, Sterling Income, refused to renovate it. Photos show that her property is in a bad condition, with furniture broken, doors missing and several holes in walls.

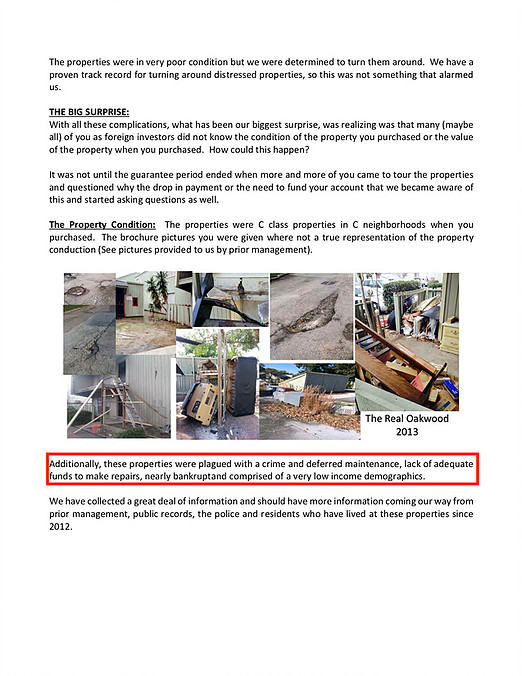

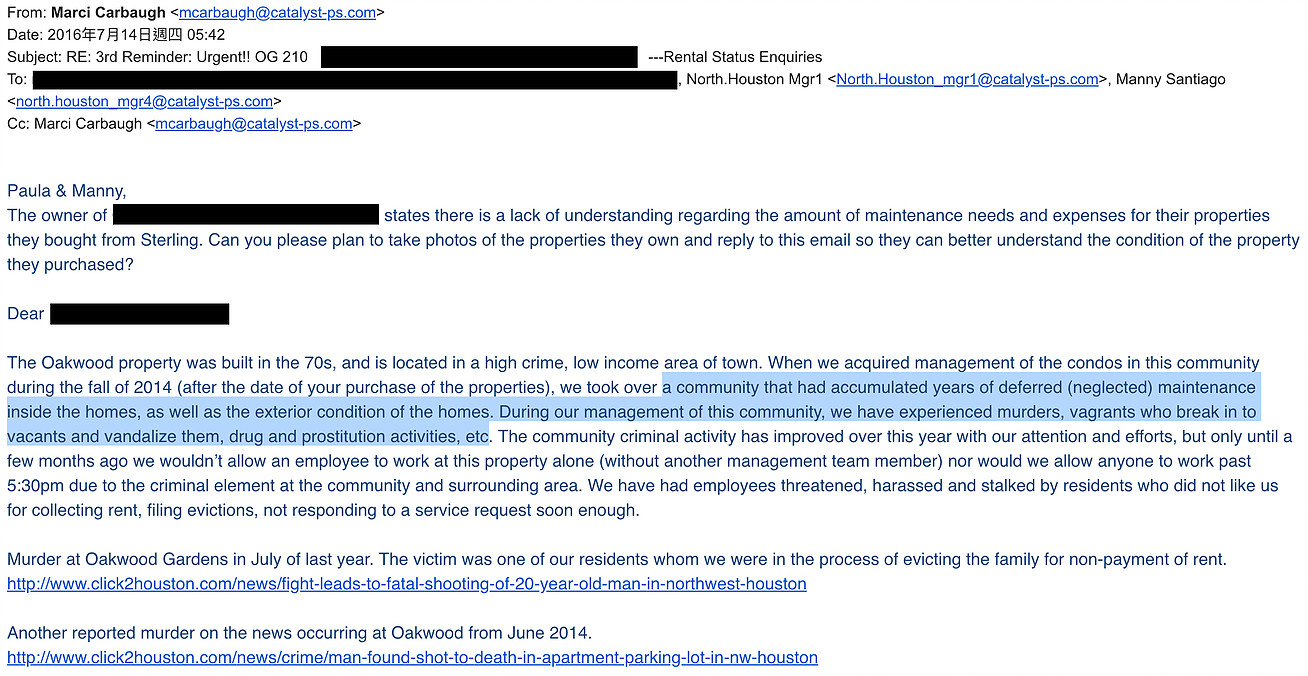

In several emails that were exchanged around 2016 and 2017, Catalyst Properties Solutions, the US company that in early 2015 took over the management of all the Houston properties Sterling Income sold through Premier Capital, told their overseas owners that the houses were generally ‘plagued with crimes and deferred maintenance, lack of adequate funds to make repairs (to common areas), nearly bankrupt and comprised of a very low income demographics’.

The company also spoke of murders, break-ins, vandalism as well as drug and prostitution activities at Oakwood Gardens, which was described as ‘fully renovated high-end apartments’ with ‘exquisite design’ in a ‘lush, pleasant and convenient location’ in Premier Capital’s marketing materials.

In photos taken by the previous property management company around 2013 to 2014, the estate grounds are overgrown with weeds, with vegetation growing on the roof. House siding also appears to be rotten, while some exterior stair treads have collapsed.

According to official property records and sales documents, Sterling Income originally purchased the houses in bulks for around US$12,000 to US$30,000 each between 2012 and 2014, and then, a few months later, sold them on to foreign investors through Premier Capital for US$55,000 to US$90,000.

However, according to the Harris County Appraisal District, which values taxable properties in Houston at their market values, a 1,184 sq ft home at Las Palmas was only appraised at US$15,854 in 2013, but was sold for US$72,400 by Premier Capital – 3.5 times more than its appraised value.

Since then, the appraised value of the same property has increased to US$37,917, but is still significantly lower than its original sales price.

Kwok, who had an unit at Las Palmas, said she was never told about the official appraised value of her property at the time of purchase. ‘I had looked at some real estate websites and the estimated value was actually comparable to my price, but later I realised the estimation was based on previous sales that were also made by Premier Capital,’ she said.

Meanwhile, investors also said that Premier Capital failed to point out there were lease restrictions in the by-laws of Oakwood Gardens and another condominium Asbury Park, which limit the number of units that can be rented out to 20 percent of total units.

Premier Capital respectively sold 77 and 71 per cent of the total number of units at Oakwood and Asbury to overseas investors, although subject to the demand of their condominium associations, owners may be liable for any violation of the leasing rule or slapped with a fine.

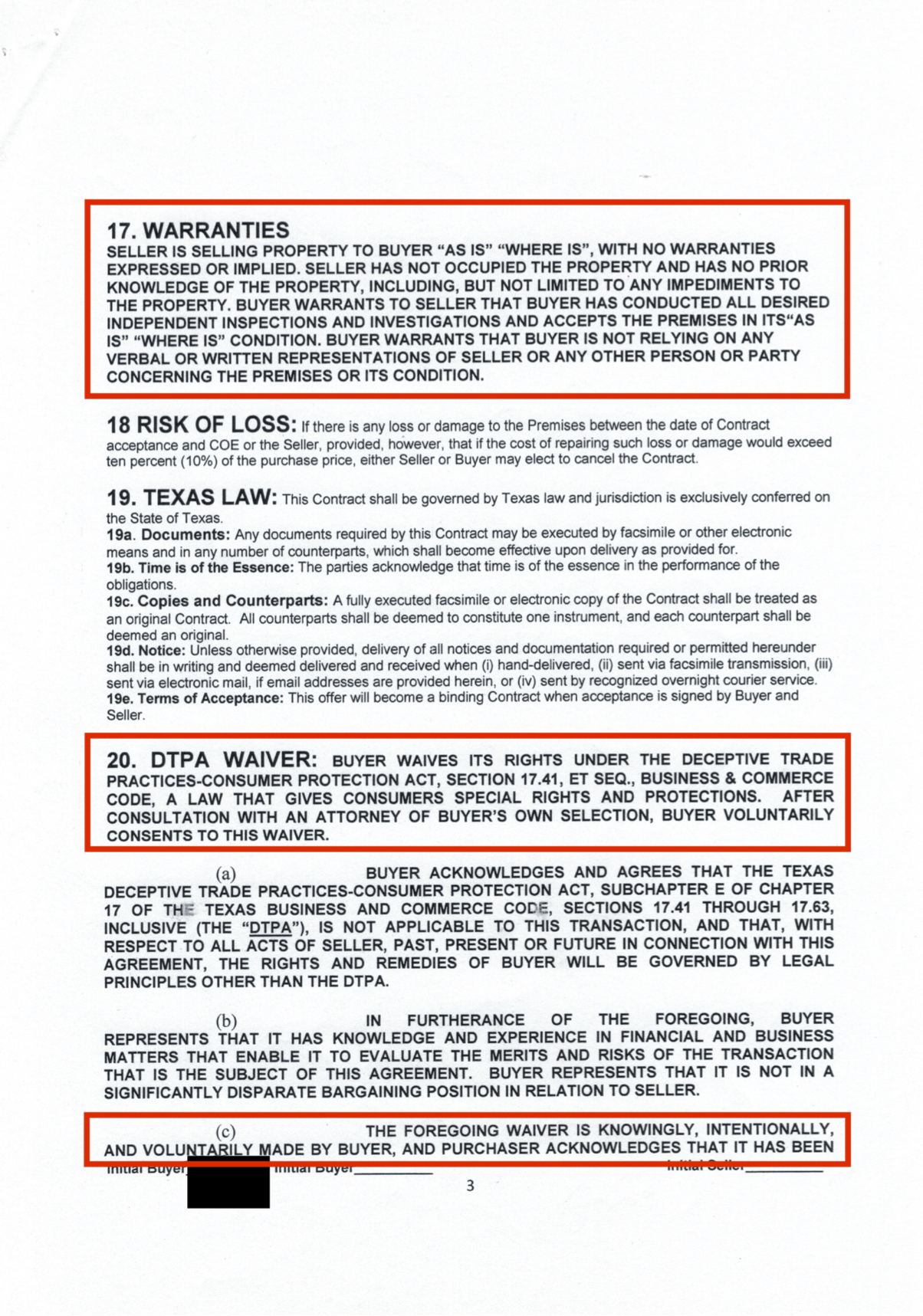

According to property deeds and purchase contracts, the houses were sold on an ‘as-is-where-is’ basis and ‘with all faults’, meaning that the buyer accepted the property condition after conducting independent inspections.

Some contracts also have a clause that requires the buyer to waive all rights under the Texas Deceptive Trade Practices Act, which normally requires sellers in a real estate transaction to disclose all known defects and conditions.

However, all of the buyers FactWire has talked to said Premier Capital did not have a lawyer present to explain the contract when it was signed nor hired a third party to inspect the properties.

Buyers also had to pay a US$2,500 ‘handling fee’ to a bank account owned by an offshore company that is also the majority shareholder of Premier Capital and at least two other related companies.

Leung, the company’s managing director, admitted to FactWire that he did not inspect all of the houses before advertising the sale, neither did he contact the then property management regarding the overall condition of the properties.

But he insisted that he had done ‘all necessary due diligence’ in the sale at the time and was not aware of any defects in the houses or crime issues at the properties.

‘I cannot guarantee all of the houses were in the same condition. There were over 100 units and I could only view a few selected units that were vacant,’ he said.

‘I admit that I was negligent (in Kwok’s case), but it was unintentional. I did not have a chance to view her house, and no one told me it had been used as an maintenance shop.’

Leung also denied any wrongdoing when asked about whether the information in the sales brochures, by describing the Houston properties as ‘luxury’, ‘high-end’ and ‘exquisitely designed’, was misleading, saying ‘everyone can have different definitions and interpretations’.

‘I am only a broker, did the buyers also have some responsibility to do their own due diligence?’ added Leung, ‘Did they go and view the properties themselves? I did, but is it unfair to question why I did not check the roofs too?

He stressed that he did not know how much Sterling Income paid for the properties, saying Premier Capital was only its sales representative and earned a 15 per cent commission from the deal.

According to Texas law, any person engaging in real estate brokerage from outside of the state is required to have a local license as long as the property is located in Texas.

But the rule does not apply to real estate that is promoted as an investment opportunity, according to the Texas Real Estate Commission. “If this company is only putting together an investment, that is not considered real estate brokerage activity,” Karri Lewis, general counsel of the estate agent regulator told FactWire.

According to Premier Capital’s website, the company was established in Hong Kong in 1988 and has offices across 12 Chinese cities, and in Australia, the US, the UK, New Zealand and Singapore. It also described itself as the ‘largest overseas property investment and migration consultancy group’ in China.

In 2000, the real estate company and Leung, as its managing director, were found guilty of issuing and in possession of investment-related advertisements and promotional documents that had not been authorised by the Securities and Future Commission.

It was caught in another legal dispute in 2005 when a group of Hong Kong investors sued a New Zealand developer over more than 200 hotel apartments which they later discovered they could not legally live in.

Premier Capital was the Hong Kong representative of the developer in the sale, but was not named in the New Zealand court case, the South China Morning Post reported at the time.